Get Complete Control of Your Cash Flow Using These 7 Key Numbers

The easiest, fastest way to managing your business for consistent, predictable and sustainable cash flow - in just 10 minutes per day.

Always have a clear picture of where your business is in financial terms, and where will be...

Save time and energy... and gain the freedom that comes from effective business management and planning.

We hate spam and vow not to bombard you with annoying emails or to EVER share your information with any 3rd party.

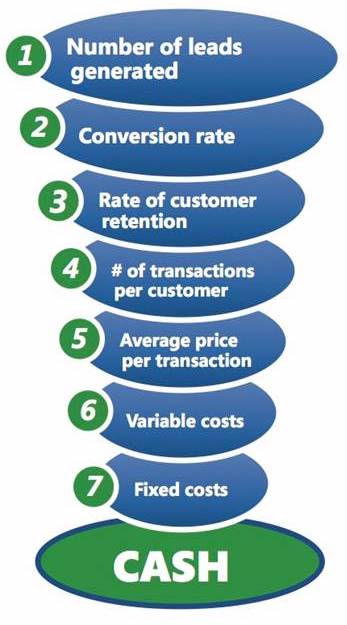

WHAT ARE THE 7 KEY NUMBERS?

#1. Number of Leads

The first number is the Number of Leads coming into your funnel. Since all income comes from customers, you need a consistent, healthy stream of new prospects entering your pipeline. The Number of Leads measures this stream and will tell you how effective your marketing is. The better you are at getting new leads, the faster your business can grow and the healthier you’ll be.

#2: Conversion Rate

This measures the number of leads that actually become customers. This number will tell you how effective your sales process is. This is a critical part of your income stream. Since most of us love to do what we started our business to do – but hate to sell, this is a number we tend to overlook. Don’t make that mistake! Too many businesses are great at marketing and poor at sales. Remember this, no sales, no money.

#3. Customer Retention Rate

That is, how many current customers will continue to do business with you after the first transaction. The more customers you keep, the less new customers you need to get. That could lower your costs per transaction. When you form a relationship with a customer, are they a ‘customer for life?’ Or do you think of it as a more short-term relationship? Even high-ticket buyers, like auto and homebuyers, should be looked at as long-term repeat buyers. After all, you want your business to be around for the long haul, don’t you?

#4. Average Number of Transactions

Number 4 measures how many times during a given period of time will a customer do business with you, or the average Number of Transactions per customer. Again, too often we think in terms of one big transaction. Think of your local auto dealership, though. They sell a car for a large dollar amount, but they offer parts and service that keeps buyers coming back on a regular basis. In fact, that dealership makes more on the subsequent transactions than they do on the sale of the vehicle! Homebuyers purchase a home, but then often there is remodeling, additions or even routine maintenance that can add to your bottom line.

#5. Average Transaction Amount

Number 5 measures your Average Price or Ticket per Transaction. In any given visit, how much will each customer spend on your goods or services. If you measure that, you can begin to answer the next question, “What can I do to make that number bigger?” Is it by raising your prices or selling more goods and services every time you work with that customer.

#6. Variable Costs

While the first five numbers address the money that comes into your business, #6 measures how effectively you use your resources in purchasing, producing and fulfilling your customer’s purchase. And frankly, failing to monitor this number can sink a business fast! But fortunately, I’ve learned some business-saving ways to control variable costs that can work for any business, and I’ll be sharing these as part of this program.

#7. Fixed Costs

This measures your general business overhead and expenses. Finding the right balance between location and rent or mortgage, for example, can be tough. Do you base your decisions on past business or potential business? How to do you know when it’s time to increase your investment or to cut back on overhead? Those are important questions, and fortunately, the formulas I’ll share with you can help you get and keep control of your overhead and expenses, and help you make the right decisions time after time.

BEGIN TRACKING AND CONTROLLING YOUR 7 KEY NUMBERS. EXCEL WORKSHEET AND INSTRUCTIONS ARE INCLUDED. SIMPLY COMPLETE AND SUBMIT THE FORM ABOVE.

c. 2019 - Cash Flow Engineering